“To solve any problem in forestry, first figure out where the roads will go.”

That’s a quote I’ve heard a retired university professor tell students a number of times. There is a lot of wisdom in it: many forest resources are located in remote areas. Hauling products from the woods to the mill can be challenging. The economics of utilizing wood becomes less appealing if forest products are located far away from the mill that processes it.

The COVID-19 pandemic led to greater challenges to the trucking industry, with shutdowns and slowdowns impacting supply chains across many industries. After all, working from home is not an option for truckers.

This makes truckers an essential part of the forest products industry. Not unlike the logging industry, the average age of truckers is increasing. Many loggers and truckers are at retirement age or will reach retirement age within the next 10 years. Recruiting a new cohort of younger workers to take their place is a challenge that many companies in the industry are facing.

The forest products industry, along with others, is facing a workforce shortage in truckers. This presents a tremendous concern that will impact the supply of wood to mills, the viability of the forest products industry, and ultimately the health of forests.

Truckers that haul products from the woods to the mill might have better-paying options doing the same kind of work in other industries. For example, in Maine, a recent study observed that trucker wages in growing industries such as merchant wholesalers (e.g., big box stores) offer wages significantly higher than similar jobs in the forestry and logging sector.

Truckers in the forest products sector also face challenges in their daily work that may not be found in other sectors. Logging truckers deal with significant wait times at mills, which may limit the number of trips a trucker can haul in a day. Logging truckers must also follow federal weight limits on roads, which often means avoiding interstates and trucking on state and local roads, adding additional time to trips. While many efficiencies have been made in logging equipment in the last several decades, fewer advances in technology and equipment have been made to log trucks and the trucking process.

Trucking workforce data

Data from the US Bureau of Labor Statistics quantifies wages in different industries using the North American Industry Classification System (NAICS). Specific occupations are listed within each NIACS classification.

For the data presented in this article, all Heavy and Tractor-Trailer Truck Drivers were obtained if total employment in an occupation was at least 4,750 workers.

Across all US states, data from May 2021 indicated 8,070 truckers employed in the Forestry and Logging classification. Truckers in this classification earned a median of $22.66 per hour. This represents a 16.6% increase since prior to the pandemic in May 2019.

A few other statistics about truckers in the Forestry and Logging classification:

- Eighty percent of logging truckers earned between $14.65 and $29.49 per hour.

- Fifty percent of logging truckers earned between $18.02 and $23.73 per hour.

- The annual median wage of logging truckers was $47,130 per year.

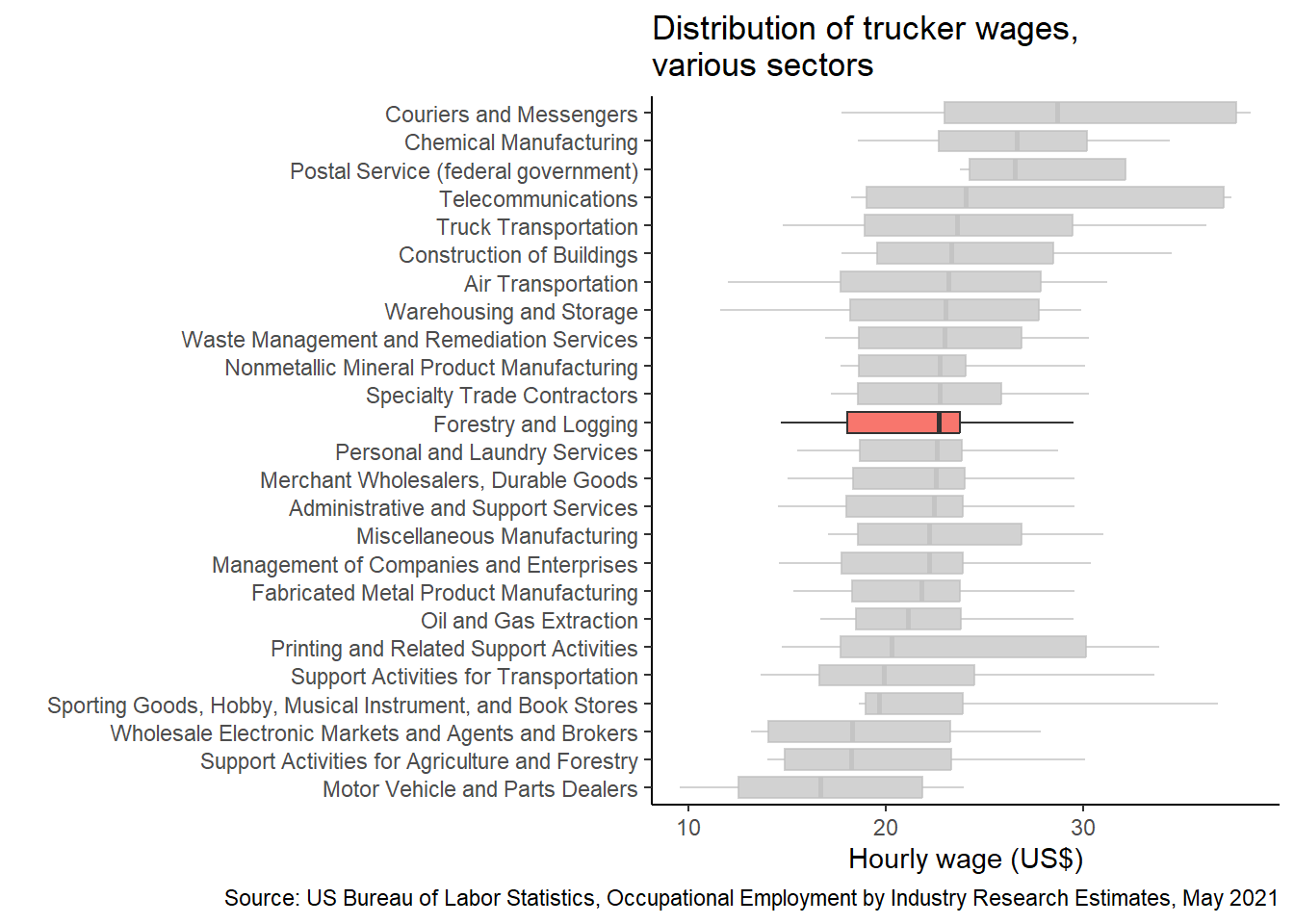

The following figure shows the 10th, 25th, 75th, and 90th percentiles along with the median for hourly trucking wages. Compared to the top 25 industries that employ Heavy and Tractor-Trailer Truck Drivers, truckers in the Forestry and Logging industry rank 12th median hourly wage:

While logging truckers earn similar rates compared to other sectors, the distribution of their wages is much narrower. The 10th percentile of wages for logging truckers is the eighth lowest across all sectors. The 90th percentile of wages for logging truckers is the fourth lowest across all sectors.

In summary, truckers in the logging industry face a number of challenges to remain competitive with similarly-skilled truckers in other professions. Logging truckers also face barriers to productivity such as long wait times at mills, federal weight limits on roads, and lower wage potential compared to other industries.

–

By Matt Russell. Sign up for my monthly newsletter for in-depth analysis on data and analytics in the forest products industry.